Bitcoin (BTC) dropped below $107,000 over the past 24 hours, triggering a wave of liquidations and renewed predictions of further declines.

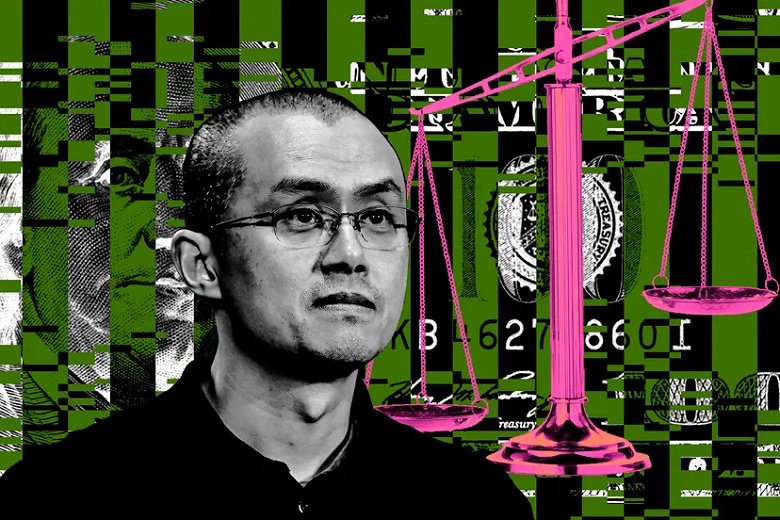

Amid this pullback, Binance co-founder Changpeng Zhao (CZ) reminded the crypto community that volatility is a natural part of the market and that additional dips are likely. Historically, CZ has encouraged investors to remain calm during sharp corrections.

According to Coinglass, the total liquidation volume over the last day reached roughly $878 million, with $766 million coming from long positions.

Market Sentiment and Analyst Insights

Analysts at Santiment observed a surge in forecasts predicting BTC could fall below $100,000. However, they noted that such panic periods are often accompanied by short-term rebounds.

“Markets move opposite to crowd expectations. A bounce is likely when fear peaks. Be a contrarian: buy when others are fearful, sell when they are greedy,” Santiment advised.

The Fear & Greed Index dropped five points in 24 hours to 29, indicating prevailing fear among investors (source: Alternative).

Psychological Perspective

Researcher Avinash Trivedi emphasized that these drops test investor patience, but they often precede the most significant breakthroughs.

Crypto investor and Moonrock Capital co-founder Simon Dedic reminded that panic-driven periods are common in crypto markets:

“I’ve been in the industry for nine years. Walking away would have been the worst choice I could make. Staying in the game each time has proven to be the right decision. Simply continuing to participate makes you a winner by default,” he wrote.

The recent BTC decline led to mass liquidations, yet most analysts agree that emotional spikes primarily amplify volatility rather than dictate long-term trends.