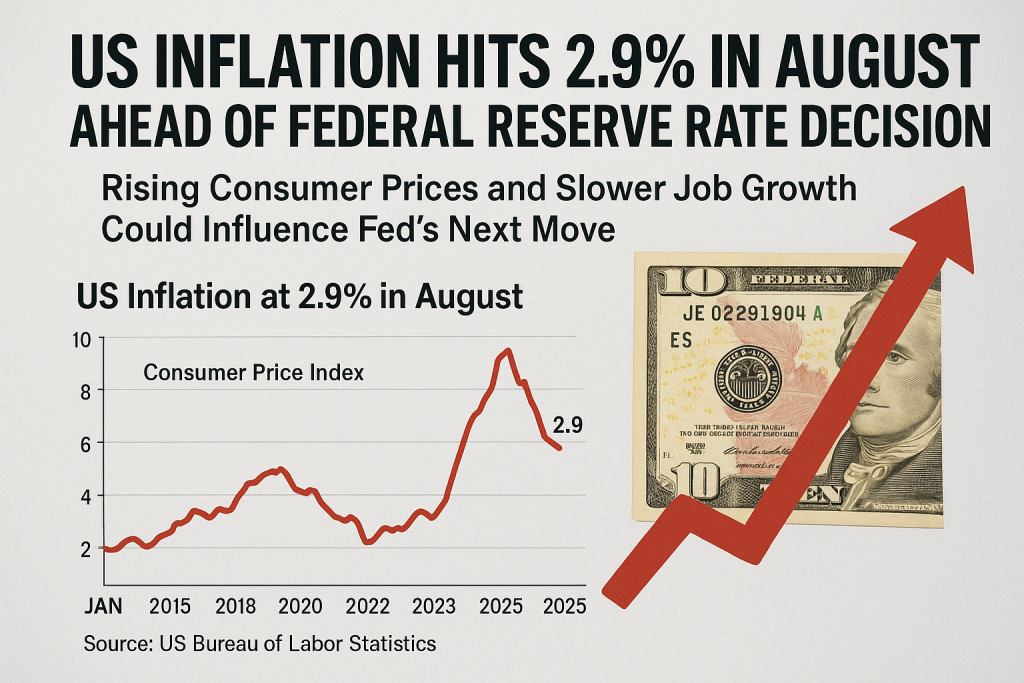

Inflation in the United States accelerated in August, reaching a 2.9% annual increase—the fastest pace this year—just before a critical Federal Reserve interest rate decision. According to the latest US Labor Department data, consumer prices rose from 2.7% in July, fueled by higher costs for cars, household goods, and food staples like tomatoes and beef.

The Federal Reserve has kept interest rates unchanged since last year, carefully monitoring the impact of President Donald Trump’s tariffs on consumer prices. Trump and some allies have criticized the Fed for not cutting rates as aggressively as other central banks, including the UK and Europe. Analysts widely expect the Fed to reduce interest rates by 0.25 percentage points next week.

Economists warn that the recent inflation increase may encourage caution among policymakers. Atakan Bakiskan, US economist at Berenberg Bank, said, “President Trump’s tariffs and immigration policies are gradually affecting consumer purchasing power.” Despite this, Trump has dismissed concerns about rising prices or economic slowdown.

Most imported goods now face tariffs of 10% to 50%, depending on origin, which has caused prices of sensitive products like clothing and household items to rise. Food inflation has also increased, partly due to these policies. For example, tomato prices jumped 4.5% in August, with about 70% of US tomatoes imported from Mexico, where a 17% tariff was applied last month.

The Federal Reserve is also watching the labor market closely. In August, US employers added just 22,000 jobs, fewer than expected, while unemployment increased from 4.2% to 4.3%. Annual job growth figures were revised downward by 911,000 jobs, and weekly unemployment claims reached 263,000—the highest in nearly four years.

Core inflation, which excludes volatile food and energy prices, remained steady at 3.1% year-on-year. Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management, said, “Inflation is a key factor, but the labor market is still the main story. This suggests a likely rate cut next week, with more possible in the coming months.”

A chart titled “US Inflation at 2.9% in August” shows trends in the Consumer Price Index from January 2015 to August 2025. Prices fell 0.2% in early 2015, rose to 2.9% by mid-2018, dropped to 0.2% in May 2020 during the COVID-19 pandemic, spiked to 9.0% by June 2022, then fell to 3.1% in June 2023, before reaching 2.9% in August 2025. Source: US Bureau of Labor Statistics.

Trump has also criticized the Bureau of Labor Statistics (BLS), which gathers employment and inflation data. Last month, he dismissed the BLS head, alleging—without evidence—that job numbers were manipulated. The Labor Department’s inspector general is investigating the BLS’s data collection processes.