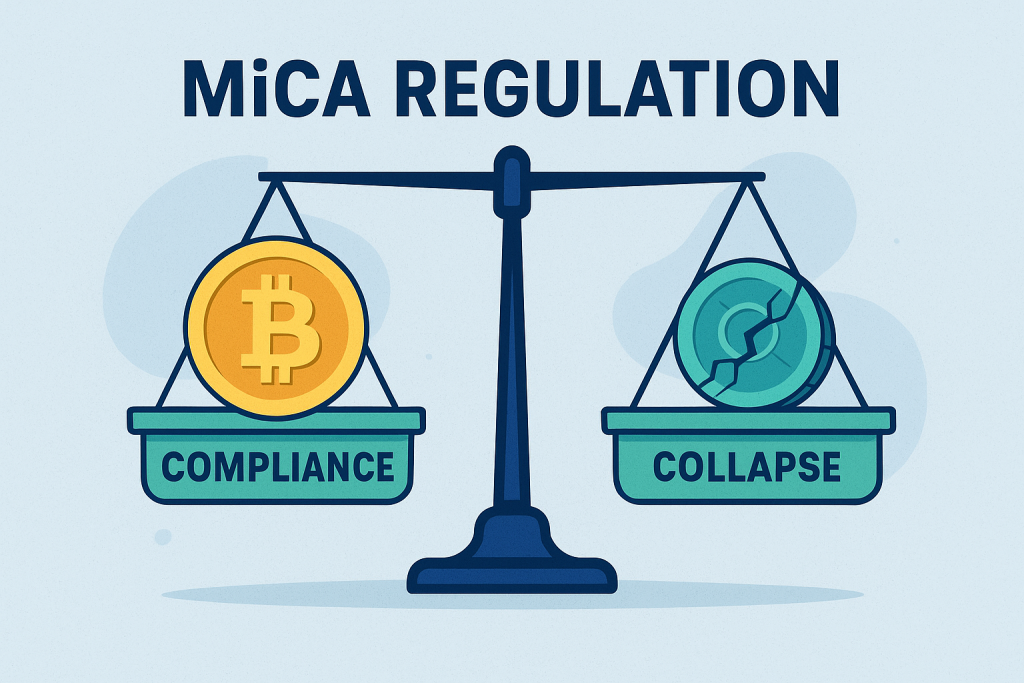

The European Union’s Markets in Crypto-Assets (MiCA) regulation is set to become a defining moment for the digital asset industry. Designed to bring clarity and transparency, MiCA establishes a standardized legal framework for crypto businesses across the EU. While many see this as a milestone that will legitimize the sector, it also presents a “survival test” for projects unable to meet the new compliance standards.

Winners of MiCA:

Projects that emphasize transparency, security, and investor protection are expected to thrive. Licensed exchanges, compliant stablecoin issuers, and custodial service providers that already adhere to strict operational guidelines will gain a competitive advantage. These firms will benefit from increased investor trust, easier access to institutional capital, and the ability to operate across all EU member states with a single regulatory approval.

Losers of MiCA:

Smaller projects and startups that lack resources to comply with extensive reporting, licensing, and capital requirements may struggle. Token issuers that previously operated in regulatory grey areas will now face high barriers to entry. For many, the cost of compliance could outweigh the benefits, forcing them to either shut down or move operations outside the EU.

The Bigger Picture:

Despite these challenges, MiCA could reshape the European crypto market into one of the world’s most secure and investor-friendly environments. By eliminating uncertainty, MiCA sets a precedent for global regulation and may inspire other regions to adopt similar frameworks. Ultimately, the regulation draws a clear line: adapt to transparency—or collapse under the weight of non-compliance.