On September 17, 2025, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve took a long-anticipated step, cutting the federal funds rate by 25 basis points to a new range of 4%–4.25%. This marks the first rate reduction since December 2024, signaling a cautious shift in monetary policy despite mixed signals from the broader U.S. economy.

Bitcoin’s Modest Upswing

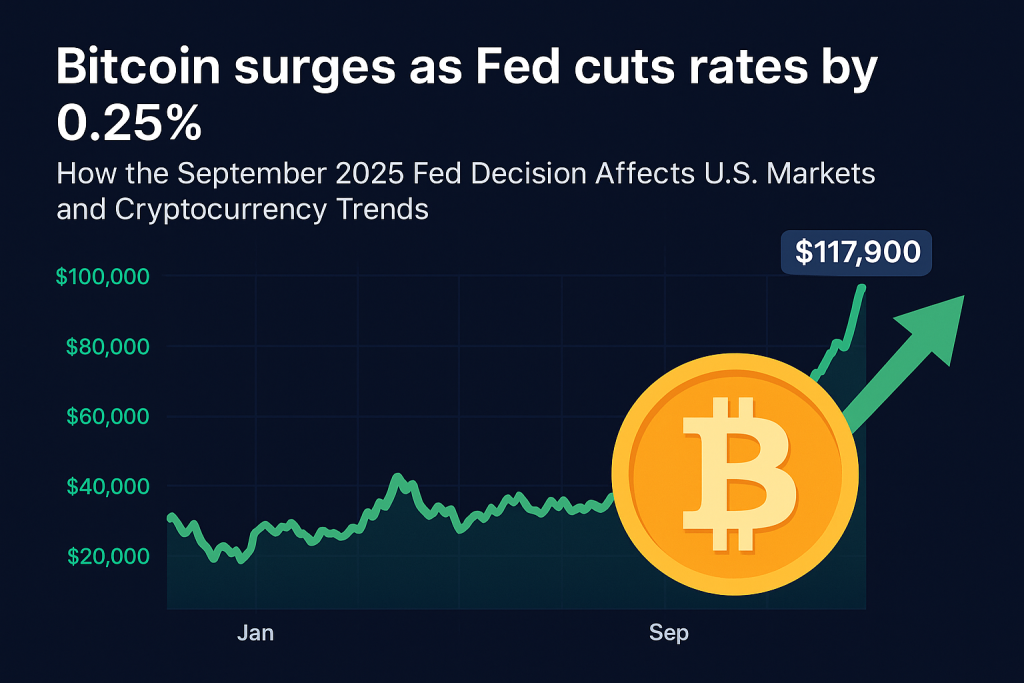

The crypto market reacted quickly. Bitcoin (BTC) jumped to nearly $117,900 immediately after the announcement before pulling back slightly. Analysts note that the move reflects investor expectations of increased liquidity in the medium term, but short-term volatility remains the dominant theme.

This reaction aligns with long-standing market behavior: risk assets, including cryptocurrencies, often rise when borrowing costs fall, as investors seek higher-yielding alternatives to traditional markets.

Powell’s Message: No Support for Aggressive Cuts

At the post-meeting press conference, Fed Chair Jerome Powell emphasized that while the central bank recognized cooling growth and labor market weakness, there was no broad support among FOMC members for a more aggressive 50-basis-point cut.

Powell highlighted several key economic concerns:

- U.S. GDP growth slowed to 1.5% in H1 2025, down from 2024 levels.

- Consumer spending has weakened.

- The housing sector remains soft.

- Unemployment rose to 4.3% in August.

- Job creation slowed sharply to just 29,000 new positions per month.

- Wage growth continues to outpace inflation, though at a moderate pace.

- Inflation in goods accelerated, pushing headline figures higher.

Despite inflationary pressures, Powell noted that risks from a weakening labor market currently outweigh those tied to higher prices.

Political Backdrop and Fed Independence

The September meeting was also marked by political tension. Just weeks earlier, President Donald Trump dismissed Lisa Cook, the first African American woman to serve on the FOMC, citing alleged mortgage fraud. Cook has since filed a lawsuit against the administration, arguing the move was politically motivated and legally unjustified.

The controversy—combined with Trump’s appointment of Steven Miran, a known ally, to the FOMC—has fueled debate over the independence of the Federal Reserve. Some commentators argue that political interference could complicate the Fed’s already delicate balancing act between inflation control and labor market support.

Market Outlook: What’s Next?

Looking ahead, the CME FedWatch Tool places the probability of another 25 basis point cut at 87.7% for the October 28–29 FOMC meeting, with just 12.3% expecting no change.

For traditional markets, further easing could support equities and bonds, though the Fed’s cautious stance may limit immediate upside. For Bitcoin and crypto markets, rate cuts continue to serve as a tailwind, boosting their appeal as alternative assets in an environment of lower yields.

The Fed’s September rate cut marks a turning point in U.S. monetary policy, balancing persistent inflation with signs of labor market weakness. While Powell made clear that aggressive easing is not on the table, investors remain confident that more cuts are coming in 2025.

For Bitcoin, the move provided a short-term lift and reinforced its role as a hedge against monetary uncertainty. But with political pressures mounting and the Fed walking a fine line, both traditional and digital markets should prepare for heightened volatility in the months ahead.