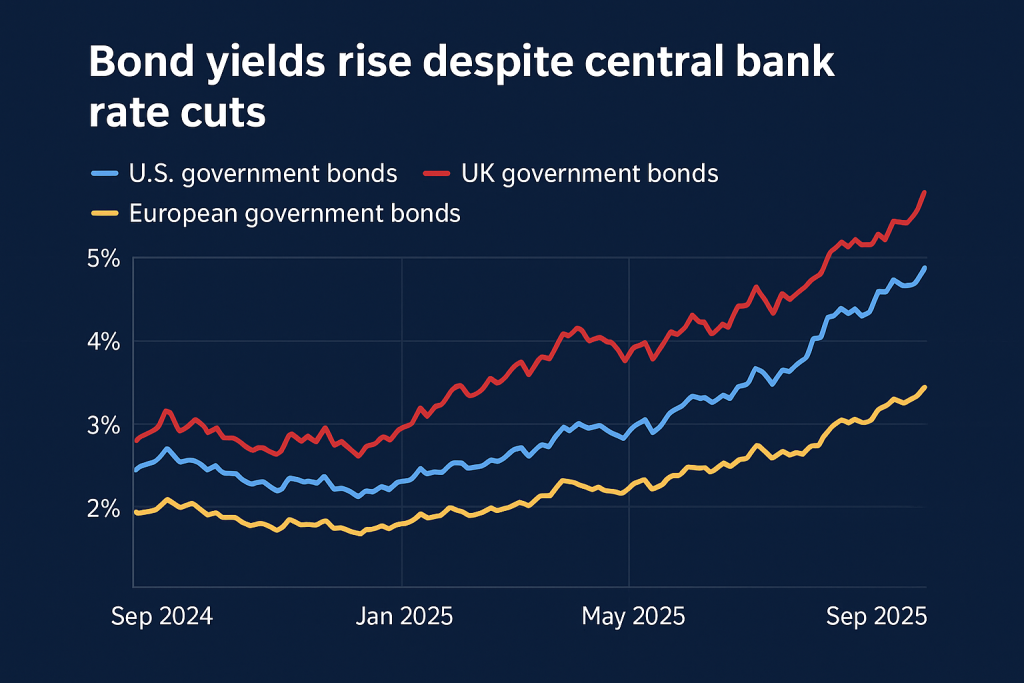

Rising Yields Despite Rate Cuts

In September 2025, the U.S. Federal Reserve cut its key interest rate by the expected 25 basis points. However, Treasury yields unexpectedly rose, indicating that market participants had anticipated a softer signal from the regulator. This movement reflects growing investor concerns about future inflation and the resilience of the U.S. economy.

UK: Long-Term Yields Reach Record Levels

Long-term UK gilt yields have reached new highs. Investors are factoring in persistent inflation and stronger expectations around government debt, making long-term sovereign bonds increasingly attractive for hedging risk.

Europe: New Tools for Hedging

Euronext has launched new futures contracts on European government bonds, including 10-year bonds from France, Germany, Italy, and, for the first time, 30-year Italian BTPs. These instruments provide investors with additional opportunities to manage volatility risk and strategically plan portfolios in a shifting market.