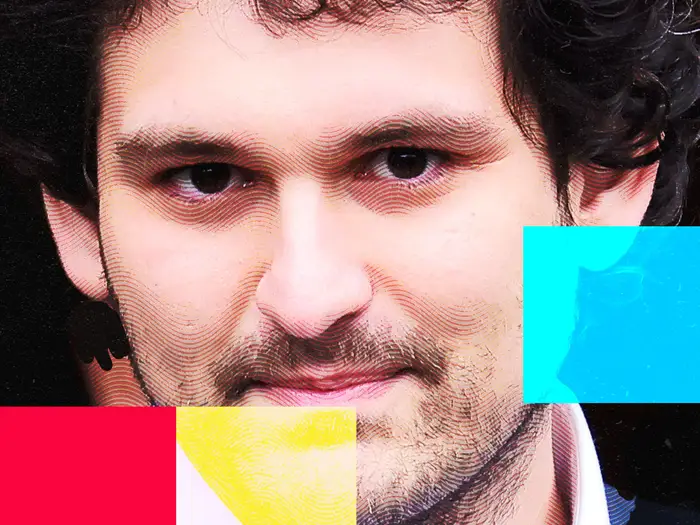

Sam Bankman-Fried (SBF), the former CEO of FTX currently serving a 25-year prison sentence, has released a new document alleging that FTX and Alameda Research were never insolvent — and that lawyers overseeing the bankruptcy “seized control” of the company for their own benefit.

The document, posted on SBF’s verified X (formerly Twitter) account, accuses the legal team managing the bankruptcy of manipulating the process, underselling assets, and misleading the court and creditors.

FTX Was “Always Solvent,” Claims SBF

According to the 30-page file dated September 30, 2025, FTX reportedly held $14.6 billion in assets at the time of its collapse in November 2022.

SBF argues that all affected clients have either received or are set to receive between 119% and 143% of their deposits, with 98% of users already repaid an average of 120%.

“After paying $8 billion in claims and $1 billion in legal fees, the company still had $8 billion left. FTX was never insolvent — not in 2022, not now,” the letter reads.

Bankman-Fried characterizes the downfall as a liquidity crisis, not insolvency, claiming that the situation could have stabilized within weeks if the company had not been placed under court control.

He further asserts that, had FTX survived, its valuation — including stakes in Anthropic and other portfolio companies — could now exceed $136 billion.

Accusations Against Sullivan & Cromwell

The document names Sullivan & Cromwell, the law firm managing FTX’s bankruptcy, as the key instigator of what SBF calls a “corporate capture.”

According to him, these attorneys had strong incentives to file for bankruptcy, as doing so allowed them to draw fees “at their own discretion” from FTX’s multibillion-dollar estate.

He claims the firm:

- Provided confidential information to the court despite still representing him,

- Sold company assets at below-market prices,

- Fired critical staff, and

- Delayed proceedings to maximize legal payouts.

SBF estimates that clients and shareholders lost around $120 billion due to these decisions, arguing that “FTX was not a fraudulent scheme” and could have paid all debts in full.

Pardon Speculation Resurfaces

In February 2025, Bankman-Fried publicly stated that he hoped to receive a presidential pardon from Donald Trump.

A New York Times report in March claimed his inner circle had been lobbying for such an outcome, though no formal request has been filed.

CoinDesk — the outlet whose 2022 exposé triggered FTX’s downfall — called SBF’s new post “an attempt to reshape the narrative in his favor.”

Meanwhile, well-known blockchain investigator ZachXBT criticized the statement, noting:

“The fact that illiquid investments are now worth more is pure coincidence. You clearly haven’t learned from your time in prison and are repeating the same misinformation.”

He added that SBF’s arguments ignore one key fact: FTX could not fulfill user withdrawals in November 2022, regardless of how much its venture holdings have since appreciated.

Sam Bankman-Fried, once hailed as a crypto prodigy, was convicted in 2024 of fraud, money laundering, and conspiracy.

He has repeatedly appealed the decision, maintaining that FTX’s collapse resulted from a liquidity crunch, not systemic fraud.

The new “leak” from his account — which may have been posted by a close associate — reignites debate around his legacy, the fairness of the FTX bankruptcy process, and the blurred line between mismanagement and criminal intent in the crypto industry.